Time Well Spent - 2/2/2024

Dog Days of Winter

For the first time ever, parents going through IVF can use whole genome sequencing to screen their embryos for hundreds of conditions. Harness the power of genetics to keep your family safe, with Orchid. Check them out at orchidhealth.com.

Your time is finite. Your phone and the internet stand ready to help you squander it. Here are my latest picks for spending it well instead. Feel free to add more in the comments.

Books, what else?

It has been over 16 years since the Great Recession of the aughts began, lasting a year and a half, from December 2007 until June of 2009. That downturn has left its cultural and economic marks, traumatizing a generation of older millennials who graduated into the worst downturn in the US since World War II (the recession of 2007-2009 heralded the dive in fertility from 2.1 to 1.6 in the US). In contrast, the COVID-19 recession lasted a few months, and despite its sharpness, has left little lasting economic or demographic impression. The inflation of the last few years has not been accompanied by a major economic slowdown. In reality the US has not been through non-pandemic economic stress since the beginning of Barack Obama’s first term. This is in sharp contrast with the Eurozone, much of which has been in recession since last year, with Germany’s economy shrinking due to reduced Chinese demand and sharply increased energy prices. And the American public’s economic grumblings pale in comparison to the widespread pessimism in China today.

As of now, American interest rates are at a generational peak. The Federal Reserve raised them, as expected, to cool down an overheated economy that was inflating prices due to excessive demand as well as supply shocks, it’s worth bearing in mind that historically these sorts of interest rate spikes presage a recession. Over the short-term, few predict a downturn; despite some weaknesses, the US is the world’s strongest major power still experiencing both strong growth and a tight labor market. But major structural issues might cause problems in the near future. The US debt is massive, and we now spend more on interest than defense. Soon interest on debt payments will surpass social security. Still, the US can print more money because we are the world’s reserve currency. But what if that changes? Then the US becomes just another nation, and our economic weaknesses will become much more salient as the water recedes.

As Tanner Greer says, everything changes slowly until it changes fast. During the last recession many people, myself included, temporarily discovered an interest in economics and economic history, as well as finance. Ideally we would have that interest before the hard times, but just as we pay attention to weather when it looks to be inclement, we pay attention to economics when the good times cease rolling. If only we were wise enough to prepare for the worst when we are still safely in the best of times, because at some point within the next generation it is likely that we will no longer be the sole reserve currency, and find ourselves muddling through with our near-magic ability to spend our way out of difficult situations sharply curtailed.

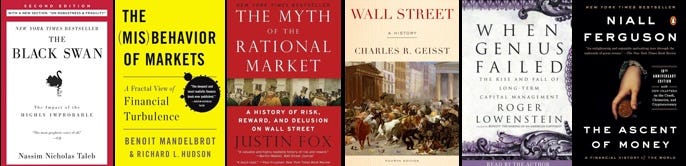

Over the last decade or so, Nassim Nicholas Taleb has become an irascible online character known for broadsides against enemies and former friends. But his 2007 The Black Swan, The Impact of the Highly Improbable was perfectly timed to make him one of the public intellectuals of that moment. And yet The Black Swan’s ideas were prefigured in his excellent earlier book, Fooled by Randomness, and originally came together in a series of essays he penned in the early aughts. With hindsight, the housing and financial crisis were probably really “white swans,” totally predictable, but at the moment the whole situation felt like a “black swan,” an improbable outlier event with massive impacts. The Black Swan may not be Taleb’s most original work, but written with verve and aimed at a broader audience, it tends to leave readers with insights that are generally applicable and stay with you.

Though Taleb is known for his passionate invective against thinkers who take issue with his views, one intellectual he repeatedly lauds in The Black Swan is Benoit Mandelbrot. An applied mathematician, Mandelbrot himself co-authored a book, The Misbehavior of Markets: A Fractal View of Financial Turbulence. Though sections are characterized by the turgidity you might expect from a mathematician whose native language is French, The Misbehavior of Markets remains an excellent window onto the mind of someone whose work serves as a foundation for many popularizations. Before his 2010 death, the 2008 financial crisis brought Mandelbrot’s thinking to the fore, breaking him out of academia and the world of applied mathematics. If you read The Misbehavior of Markets you’ll come away with a deeper appreciation of the irregularity and volatility of finance as an enterprise which makes terms like “financial engineering” or “financial technology” seem like a joke.

Where Mandelbrot pulls readers into a more abstract and intellectual domain, Roger Lowenstein’s When Genius Failed: The Rise and Fall of Long-Term Capital Management is a journalistic deep-dive into the short but prominent arc of a firm that almost triggered a financial crisis in 1998 due to its exposure to the sequential crises in 1997 in the Asian markets and 1998’s collapse of the Russian economy. These were the “smartest guys in the room” in the 1990’s, but with hindsight it is clear that Taleb’s maxims about outlier events were not considered in their models. Within their strategy was baked an assumption of imperturbable normality and disregard for extreme events which not only destroyed their company, but nearly brought down their counterparties. Lowenstein’s narrative treatment highlights the human, legal and ethical element in finance that cannot be captured by the Black-Scholes’ model. When Genius Failed is a perfect case study in privatized gains and socialized losses.

If there is one idea that stands in opposition to an embrace and acceptance of volatility as constitutive to finance, it is Eugene Fama’s “efficient-market hypothesis.” Justin Fox’s The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street is not just a takedown of Fama’s model, which underpins so much of modern investing, including index funds (“you can never beat the market”), but also highlights the predecessors of the rational market which highlight why the framework was so attractive. Fox’s book came out at the time of the financial crisis, so it was well-timed to leverage schadenfreude over the hubris of financial engineers, and like When Genius Failed it illustrates the reality that very bright people with the most sophisticated of models can still be taken to the cleaners when reality does not conform to their theories. While Lowenstein’s narrative is tightly focused on the character and firm of LTCM, Fox’s The Myth of the Rational Market ranges over decades and the whole global economy, reviewing its successes and pitfalls, and touching on topics like the rise of speculative investing in southern California’s housing markets and its connection to financialization of real estate.

Charles R. Geisst’s Wall Street: A History tacks away from the theoretical, bringing us back to the concrete and historical. Geisst begins with the Dutch period, and 17th-century New Amsterdam’s role as a New World entrepot and transaction hub. The updated latest edition concludes with Wall Street's rebirth in the wake of the 2008 Great Recession. But I found the most vivid portion of Geisst’s narrative the one focused on the early 20th century, when financiers like J. P. Morgan held the entirety of the markets in the palm of their hands, and dictated the rise and fall of the economy via coordinated action. The fact that individual men like Morgan could intervene so decisively in national economic affairs finally prompted the central government to resurrect the idea of central banking, resulting in the emergence of the Federal Reserve.

And finally, Niall Ferguson’s The Ascent of Money: A Financial History of the World, gives us a panoramic global view, from the ledgers of Sumer 5,000 years ago to the collapse of the markets in 2008. Though many know Ferguson as an op-ed-page polemicist, his historical work displays more of his erudition and sober scholarly focus. The Ascent of Money takes us from the emergence of currency to its various iterations and the evolution of a modern global system of finance. If you want to know how robust or fragile this system was in its various forms, and how pervasive or novel phenomena like inflation have historically been, then Ferguson’s narrative is the place to start (like many deficit-hawk commentators, Ferguson was correct about the perils of excessive spending, including inflation, but those prophetic warnings are hitting home more now than when they were mooted around the Great Recession).

Thought

Dentists are bad: A field full of scams, with incomes propped up by irrational regulation. The lack of standardization of care and cost are major issues. In this way, dentistry is decades behind conventional medicine. Also, unlike normal preventative medicine, it seems that the need for dental care varies a lot between individuals. Some people will have high expenses early, but most will not.

G.O.P. Infighting and Democratic Mischief Animate Montana Senate Race - Even as a Republican primary clash brews between an establishment-backed businessman and a far-right agitator, Democrats are subtly trying to insert themselves. I just want to note here that Montana is a generally pro-choice state. Because of the nationalization of the political parties this is not reflected in the Montana Republican party. The hardline anti-abortion position of the national Republicans may become a major issue in the fall.

The Labor Union That Defeated Amazon Is Fighting for Survival - Amazon Labor Union’s leadership has been in turmoil following internal clashes with its president. Millennials seem good at publicity via social media…but a little less so at long-term institution building because of the preeminence of personal concerns. In this case, reading between the lines it sounds like the charismatic labor leader was focused more on her own brand building than actually leaving a legacy with the union.

After Affirmative Action Ban, They Rewrote College Essays With a Key Theme: Race. They are responding to incentives. You can change a law, but that won’t change the culture. You need to do both.

How Group Chats Rule the World - They quietly became the de facto spaces to share dumb jokes, grief or even plans for an insurrection. Most people have always been in interlocking social circles, so this is just the virtualization of something that already existed.

23andMe’s Fall From $6 Billion to Nearly $0. A theme in the piece is how Anne Wojcicki’s ego has clouded the company’s path forward. Linda Avey (my podcast with her), her co-founder, was pushed out in a board coup led by Wojcicki, even though the idea for 23andMe was originally Avey’s.

Data

Stable population structure in Europe since the Iron Age, despite high mobility. This paper seems to confirm the “urban graveyard” or “sink” effect. Ancient DNA here shows genetic diversity and heterogeneity around major urban areas at the Empire’s peak, which in a standard model should eventually result in decreased structure and between-population genetic distance over time as these pools of variation mix in with the local substrate. But this is not what we see; modern population structure seems to mirror the structure of the Iron Age prior to the Roman Empire. How to explain this? The idea that cosmopolitan urban areas are culturally and historically significant, but demographically unimportant, is strongly supported by these results. If the people in the cities died off with the Empire’s collapse, to be replaced by local rural natives, then the pre and post-imperial genetic structure should roughly match, with the Imperial interregnum being a transient phase

Y Chromosome Sequences Reveal a Short Beringian Standstill, Rapid Expansion, and early Population structure of Native American Founders. More than 90% of Native American males are haplogroup Q. Deep sequencing of these individual chromosomes suggests a bottleneck beginning about 20,000 years ago, an expansion 15,000 years ago, and then a massive expansion in South America 12,000 years ago.

Accurate inference of population history in the presence of background selection. To make a good reconstruction of the past through models you have to have good assumptions. Not perfect, but good enough. This improvement over older models seems to allow for better past population-size estimation.

More than nature and nurture, indirect genetic effects on children’s academic achievement are consequences of dynastic social processes. What this basically means is that the 50% of the genes not transmitted to the offspring matter too in offspring outcome. So the root cause of the effect is genetic, but it’s not through Mendelian processes.

Maternal Care Leads to the Evolution of Long, Slow Lives. Basically uses simulations and modeling to confirm the hypothesis that long-lived mothers invest in their offspring, and that this whole process extends our life history.

Discussion

All my podcasts go ungated two weeks after their Substack release. So I encourage subscribers on the free plan who’d like to automatically get them to subscribe to that podcast stream (Apple, Stitcher, and Spotify). If you want to listen on YouTube, please subscribe.

Here are my guests (and monologue topics) since the last Time Well Spent:

And here are the currently ungated podcasts all in one place.

For subscribers, I post transcripts (automatically generated, though I have someone going through to catch major errors).

ICYMI

Some of you follow me on my newsletter, blog, or Twitter. But my own domain also has all my links and updates: https://www.razib.com

There you’ll find links to the few different podcasts I’ve contributed to or run, my total RSS feed, links to more mainstream or print articles when I remember to post them, my Twitter, the occasional guest appearance, etc.

Email me

DM me

Facebook message me

My total feed of content

My long-time blog, GNXP

A group blog, Secular Right, vintage at this point, but worthwhile for Heather Mac Donald’s prescience

My Indian/South Asian-focused blog, Brown Pundits

Some of my past pieces for UnHerd, National Review, The Manhattan Institute, Quillette, and The New York Times

My old podcast, The Insight

This podcast, Unsupervised Learning

Over to you

Comments are open to all for this post, so if you have more reading/listening suggestions or tips on who I should be talking to or what you hope I’ll write about in 2024, lay it on us.

I'll throw out a couple of book suggestions in line with today's books:

* "Fortune's Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street" by William Poundstone. All about the Kelly criterion.

* I'm currently reading "A Man for All Markets", the autobiography of Ed Thorp, who is a figure in the first book. Really interesting and really smart guy... I'm currently reading it aloud to my 14- and 16- year old boys and they love it.

Mandelbrot's work is not that opposed to Fama. The latter's PhD thesis was partly on efficiency but also on the distribution of stock returns, confirming Mandelbrot.

https://notepad.michaelpershan.com/qa-with-eugene-fama-on-the-bell-curve-in-finance-posted-without-commentary/

A market being efficient is different from not being volatile. It's a matter of incorporating information such that you can't beat it. Scott Sumner points out that if LTCM had succeeded, that would have instead been evidence against the EMH:

https://www.themoneyillusion.com/heads-i-win-tails-you-lose/